Listen Live:

Saturday’s: 9AM

Fox Sports Ventura

1590 AM/97.9 FM KVTA

Sunday’s: 7AM K-EARTH 101 FM

Listen Live:

Saturday’s: 9AM

Fox Sports Ventura

1590 AM/97.9 FM KVTA

Sunday’s: 7AM K-EARTH 101 FM

Monetary policy has a lag. Just because we get an inflation report that indicates we have turned the corner does not mean the journey is close to an end. I believe Powell has that “old-time inflation religion.” But there are several paths to his goal.

The end point is likely the same (give or take 25 bps).

But the market Thursday got positively giddy. The positive move in bonds was eye-opening. Not sure I have seen that size of move before. The 10-year fell 0.33% in one session! The Dow up over 1,000 points. No recession in our future! This is going to be better than a soft landing!

The market knows very little when it comes to predicting recessions. We get an inverted yield curve sufficient to signal a recession and the market shrugs it off and goes higher (2001 and 2007, etc.). Not unlike today. Let’s see what Sam Rines, Economist and Equity Analyst has to say:

“There are a couple takeaways from the rip in risk assets. First, a soft landing was not priced in. Second, the market is beginning to test the ‘higher for longer’ mantra the FOMC has been pounding at for months.”

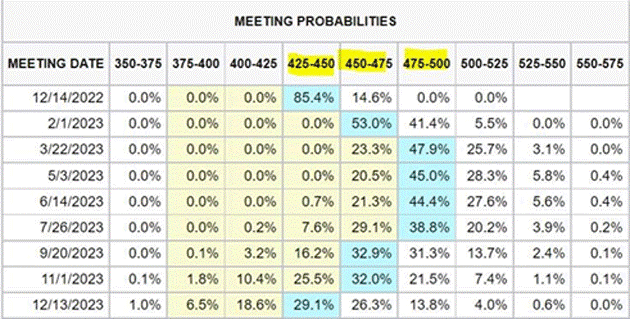

[Note from John on this chart: This is the statistical probability of rates reaching a specific point in a specific month. Go to the 3/22/2023 line. The market thinks there is a 23.3% chance for rates to be at 4.5‒4.75%. 0% chance it will be only 4.5%. An almost 50% (47.9) probability of rates being 4.75%‒5%. This also assume rate hikes of 50, 25 and 25 bips. The majority of the market is also seeing cuts in the third quarter of 2023, although a sizeable majority see more rate hikes in May/June.]

Source: Samuel Rines

More from Sam:

The risk is not ‘75 or 50’at the next meeting. The risk is more 25s than priced, and the FOMC not being in a mood to cut late next year. The reaction to today’s print was ‘case in point’ with a 25 bps point hike taken out and cut(s) being priced in late 2023.

“For the moment, the June FOMC probabilities are the ones to monitor. Why? That is where the terminal / pause is being priced. If the next jobs report is a bust, does another 25 bps come out? If it is a blowout, does the market reprice the terminal?”

Thinking out loud with no real answer: First, recessions are by definition deflationary events. What if we get a real recession in early 2023? Will that reduce inflation faster? (Short answer: yes!) Does the Fed pause or even cut if inflation really falls? That seems not an unrealistic possibility. Something to watch.

I expect a 5% fed funds rate and 5% unemployment, but perhaps not with a serious recession in the first quarter because inflation will take a tumble and the Fed has to start looking at future housing prices which will roll over in a recession but not show up for 6‒9 months at a minimum.